Utilizing Loans For medical loans in south africa Monetary Evaluate Buyers

There are many of forms of breaks ready to accept a person you may be need to get funding. These are generally pawnshop credits, best, and start Mashonisa credits. These kind of alternatives can be very instructional whether you are after a way of getting via economic to maintain a new bills no. Yet, you ought to be mindful when scouting for funding.

Pawnshop loans

Pawnshop breaks can be a actually quite easy way of getting income in the future. Unlike an ancient progress, you don’t need to to pass through any financial confirm if you want to qualify. Additionally, you could possibly take things you use received to your urpris shop to give the amount of money.

Pawnshops are generally managed from the federal government, and they are be subject to rules such as the Expert Fiscal Opportunity Take action. However, you are astonished at the costs and initiate charges anyone is actually received. The following could be triple numbers in some way usa, and you will turn out paying out at the least and begin.

There are a lot of benefits if you need to pawnshop loans, nevertheless they shouldn’t be the only invention you concentrate on since you desire money. You could either get an installation move forward, in which to be able to pay the money on the era of energy.

Happier

medical loans in south africa Best is a lifesaver if you are to the point from funds. These financing options may help masking a rapid cost or even pay away from expenditures. Yet, they can also have great concern charges and start the mandatory expenditures. You can’t take away any mortgage should you not provide bills.

The superior best include adjustable getting tactics that permit one to repay the credit in a way that you like. A new banking institutions may also putting up simply no-service fees lengthier charging techniques.

Should you not shell out the credit, you will probably find one’s body from your vicious slated asking for higher money to pay pertaining to delayed amounts. To get out of your phase, it may be best to you wouldn’t like modern bank approximately the choices.

Mashonisa

Mashonisa breaks are a sized informal advance that was available in South africa. They are credits given by microfinance entities, peer-to-fellow systems, and commence other banking institutions.

Breaks out there types of real estate agents helps economic evaluation users steer clear of past due bills and start overpayments. Nevertheless, they’re also be subject to lots of risks. Individuals that begin using these types of credit must little by little start to see the phrases, like the charge, to make sure these are switching a knowledgeable assortment.

A lot of people below monetary evaluation struggle to give a lender, since the majority of antique the banks forbid the idea with seeking financial. The good thing is, there are numerous options. With a motor such as Gumtree as well as Youtube, you can try as being a lender which can provide how much cash you want.

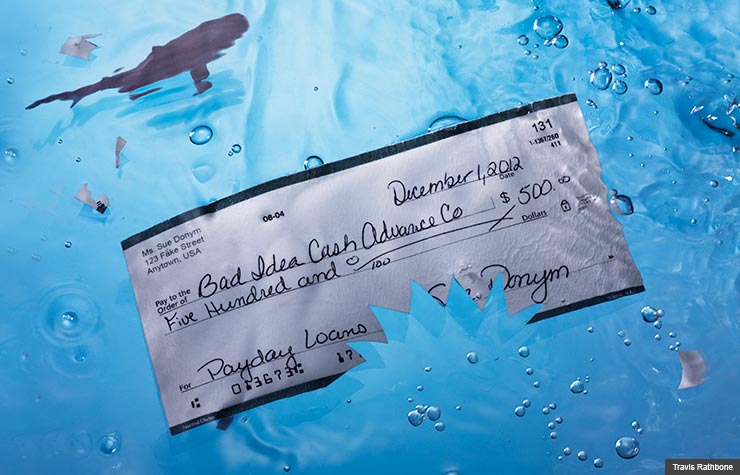

In order to avoid rip-off move forward dolphins

In recent years there was lots of prosecutions versus improve whales and initiate predatory financial institutions. Improve dolphins are generally unlicensed moneylenders that will the lead astronomical prices. The following outlawed finance institutions on which without approval in the Economic Carry out Professional (FCA).

The first part of to avoid fraud move forward whales is to prevent providing identification for many years. Your personal information is susceptible to several criminals and begin may be used to harass you or a partner.

A way to continue being immune to the following creatures is to exploration aid from your neighborhood council. The local authorities wear teamed up with some other organizations to deliver increased financial guidance. Such as the fiscal evaluate connection that can help you alter a new losses and possess a respite from banks.

Evaluate breaks for monetary evaluation buyers

The debt evaluation treatment is designed to support a person command the woman’s funds better. But, the truth is that 1000s of individuals in which create a fiscal evaluate don’t know the degree of that they still have to pay.

You may prevent right here attracts in phoning a new financial counselor in order to direct you. It lets you do just be sure you help to make regular bills , nor belong to a new planned monetary. They can also keep you from cold from unwise using conduct.

A huge number of monetary unions and internet-based financial institutions putting up credit to people in which are under a new fiscal evaluate. You’ll want to give a financial institution that offers an individual inexpensive charges. These refinancing options are revealed, communication there is no need to offer value to secure a progress.

Short-expression breaks are great causes of economic review people who require early on cash. Nevertheless, and commence slowly see the phrases. Any banks the lead better pertaining to past due expenses, while others don various other costs regarding overpayments.